Starting your business from the basics can be strenuous as it comes with many responsibilities and legal formalities. Success as an entrepreneur requires a thoughtful application of rules and trusting your instinct. There are various legal requirements for new businesses and start-ups. With some critical parts starting a business also includes emotions and fun as you achieve your dream and have the freedom to do what you love while earning money.

Running a business involves the responsibility of the employees as their financial well-being depends on you. Marketing strategy, growth strategy, and exit strategy for a business are also essential to get things going smoothly. But never forget that the legal aspect is at the top of the planning list.

Generally, lawyers associated with the company take care of all the legal aspects, but the entrepreneur must be aware of the fundamental laws to tackle and understand the problem.

Basic business laws every entrepreneur must know

Some fundamental laws guide all entrepreneurs. Success in this venture is not about fortune but about planning. It’s hard to survive in the market for a company unfamiliar with the laws and with less-experienced workers. So, it’s better to grab all the knowledge about the law in the initial stage. Here are some laws you must be aware of:

To initiate an LLC or corporation

As a new business owner, the first legal condition you need to fulfill is to pick a structure for your business. You can select between a Limited Liability Company (LLC) or a corporation. LLC will safeguard your personal liability in almost every situation. This signifies that if any legal action is taken regarding your company, your personal belongings counting your house and vehicles will be out of threat. LLC allows you to file taxes of your business income combined with your personal income. But you will need to bear self-employment tax. However, a corporation is a business that has a distinct legal system from its owner. A corporation is expensive, but it safeguards the company to its highest extent.

List your business title

After a business structure is formed next law you must be aware of is to register a name for your business. You must choose a unique name that indicates your brand. There are four types of registration processes. You can select according to your business.

- Entity Name: It secures your business at the state level

- Trademark: It safeguards at the federal level

- Doing business as: It won’t provide any safety from the law but it is essential for your business.

- Domain name: It protects your website.

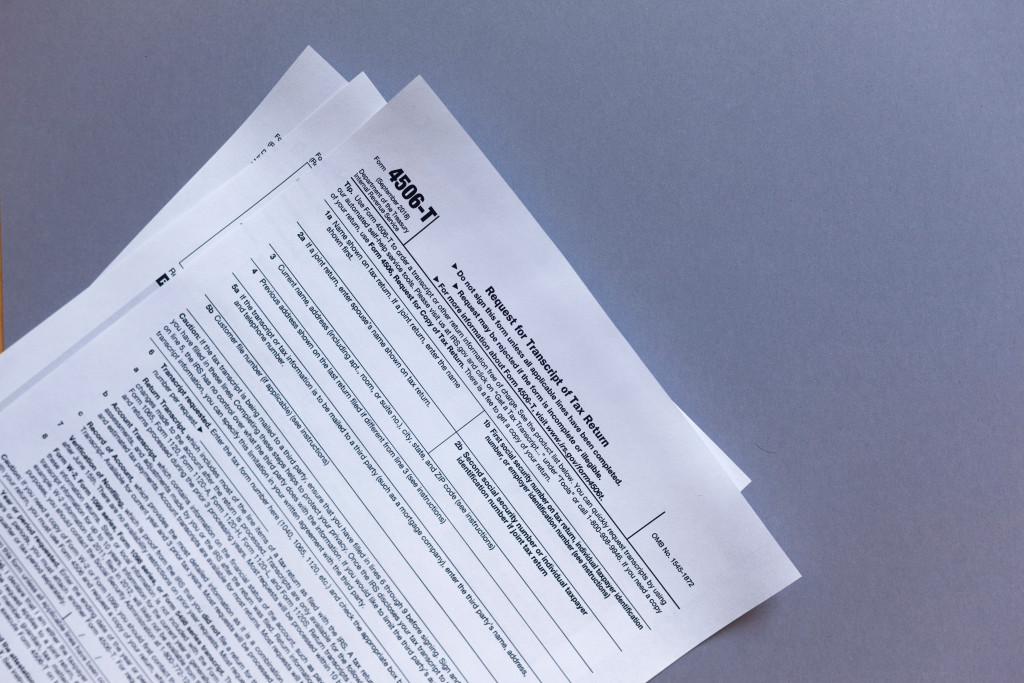

Get your Federal Tax ID digits

It refers to Employer Identification Number (EIN). The EIN holds various powers as you can legally hire employees, apply for licenses and business bank accounts. You also become liable for paying federal taxes and filing an employer’s tax return.

Research about State Tax ID Number

As the law for state tax is different for every state. Therefore, you need to find out the law as per your state. It is required only if your state asks for business taxes.

Grab permits and licenses

As per your business and location, you can enroll for the license and permits. This can list it at the state and federal government levels. At the state level, the charges are determined as per your location and business type. You must do all the research regarding the permits and licenses from the government websites.

Insurance for your Business

For protecting your personal and business assets, it’s important to take insurance for the company. You can choose from some common insurance people take at the initial stage. They are general, and product liability insurance, or you can also take commercial property insurance.

Business Bank account

Opening a business bank account is a vital point. From the legal point of view, it’s necessary to segregate your personal and business accounts before you start taking orders from your clients. As per your comfort, you can select the bank you want to open an account with. For opening an account, you have to provide information regarding your business to the bank. You need to provide your EIN, permits and licenses, ownership agreement, etc.

Learning about these laws will be helpful, and you’ll be saved from making foolish mistakes. If you’re unaware of what not to do, your competitors can take advantage of it. Legal obligations might come up at a time when you’re not doing well. Court cases cost a lot of money, and you’ll spend even more to fix the problems you’ve created unknowingly. Therefore, it’s better to understand basic legalities.